Cash flow management is the lifeblood of any business, and that includes your coaching business. The only way to create financial security for yourself and grow as a coach is to make sure your cash flow is balanced.

However, unless you’ve done business school, financial lingo can easily sound like a foreign language to you. Most guides on this topic go into intricate detail about the financial needs of big companies but fail to mention what’s actually relevant to the cash flow of a coaching business.

About 82% of small businesses fail because of issues with their cash flow, so we felt it’s time we straighten things out in this article. Read on to learn what cash flow means for a coaching business and how to manage it like an absolute pro.

What is Cash Flow in a Coaching Business?

Cash flow is the movement of money into and out of your coaching business. It’s usually calculated over a particular term, for example, weekly, monthly, or yearly.

Your cash flow is like a diagnosis of your financial health and stability. It helps you decide when it’s time to cut costs and be more resourceful versus when it’s time to invest in scaling your business. It clarifies how far you can stretch with your business expenses and when it might be time to bring in external resources.

What Is Cash Flow Management?

Managing your cash flow means regularly monitoring and optimizing the inflow and outflow of money within a business. You need to make sure that you have enough cash to cover your expenses, including paying yourself. Ideally, you should have additional funds beyond your recurring expenses to invest in your long-term business goals.

There are several ways you can manage your cash flow as a coach (which might differ from big corporations’ operations). We’ll lead you through them in just a bit.

How to Calculate Cash Flow

As a service provider, it’s best to calculate and project your cash flow at least monthly and quarterly. You can either hire a financial expert to analyze your cash flow or take it on as one of the many hats you’re wearing.

Here’s how to calculate your cash flow over a set period.

1. Identify Your Inflows

Inflows are all the ways your business receives money, including all your revenue sources, your personal investments, and any loans you may take out for your business. More specifically, these can be:

- Payments from your coaching clients

- Sales made from your paid courses, downloadables, and other products

- A specific amount you might decide to invest in your business from your own pocket

- A business loan you take out from a bank to finance your business

2. Identify Your Outflows

Make a list of all current and foreseeable liabilities in your coaching business, i.e., the areas where you owe money to other people. This includes your basic operational expenses, the salary you pay yourself and your team, taxes, and possible debts. Examples of your outflows may be:

- Office rent or coworking office fees

- Physical assets you may need such stationeries or a new laptop (or coffee, for that matter)

- Digital assets, like templates and software fees (such as your Paperbell account membership)

- Educational costs, for example, a coaching certification

- Salaries and contractor fees, including what you pay to yourself

- Marketing costs for your ads or content production

- Taxes

- Loan repayments

Give these items a due date to indicate when they are payable. This is one of the most important parts of cash flow management (you’ll see why in a minute), so don’t miss it!

3. Calculate Your Free Cash Flow

Now that you have a record of all the money going in and out of your business, you can calculate your free cash flow. In other words, the funds you have available for spending.

The simplest way to calculate cash flow in a small business is:

Free Cash Flow = Cash Inflows – Cash Outflows

This is the amount you currently have available in your account to cover operating expenses, paying your contractors and yourself, as well as paying off any debt. Your cash inflow vs outflow record is also called a cash flow statement. To manage cash flow like a pro, having efficient budget planning is crucial. Tools tailored for this purpose can seamlessly integrate actionable insights, allowing for rapid response to changing financial conditions.” so that it won’t be too long.

4. Optimize Your Cash Flow

Calculating your cash flow clarifies how your business is doing financially.

If the amount is positive, that means you have positive cash flow. In other words, your business generates more money than it’s spending. Organize your expenses and income sources in separate categories to better understand where the money goes. It makes it easier to restructure your cash flow and allocate funds to your more pressing needs.

In some cases, your cash flow might be negative over a particular period. This is when you need to develop cash flow management strategies that let you cover your timely expenses so your business can keep running.

Cash Flow Management Strategies for Coaches and Other Service Providers

And now, the part you’ve been waiting for: Here are some practical strategies and techniques you can apply to prevent poor cash flow management in your coaching business.

Advance Payments

As you’ve probably noticed, timing is everything regarding cash flow management. The sooner your coaching clients pay for your packages, the sooner you can reinvest those funds in your operating costs.

If you want to get paid as soon as possible, make advance payments a part of your payment terms. This way, clients can’t book their first session or get access to their learning materials until that money is in your account. In fancy financial terms, this is called credit control, i.e. making sure clients pay.

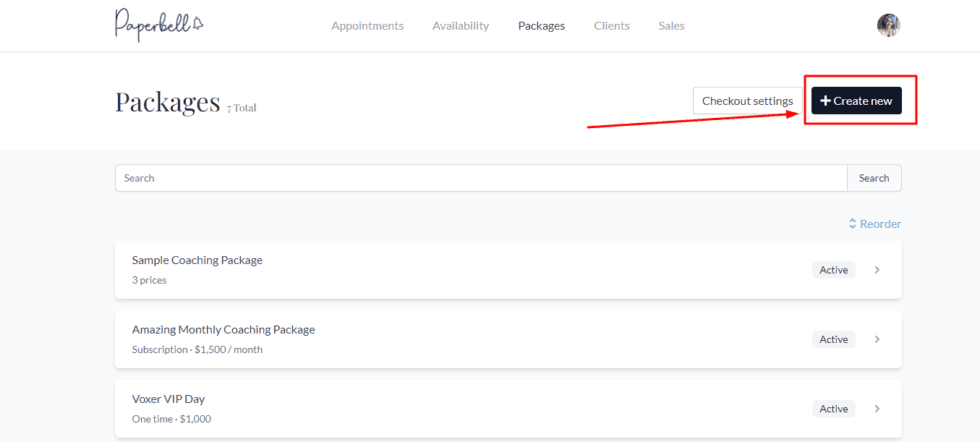

With Paperbell, you can quit following up on outstanding payments because this all-in-one platform handles it all for you. To onboard your clients, you only need to share the link to your dedicated Paperbell landing page with them. Then, they can find all the information about your packages there, settle the payment, sign your contract digitally, and book their first session with you.

You can set up your own contract terms, package fees, and installment options. Then, let Paperbell handle the rest. Best of all, Paperbell’s free with your first client.

Run a Cash Flow Analysis

Running an analysis of your outflows and inflows regularly is not just about optimizing your expenses but also about managing risks. It gets you prepared for what-ifs and unexpected situations. A little like that nagging aunt you don’t want to listen to but later realize she was annoyingly right.

Create a Plan B for situations like your big client moving on or your laptop suddenly breaking down. Better yet, have an emergency fund for unforeseen expenses or dry seasons with fewer clients knocking on your door. Having steady savings, you don’t touch is one of the best ways to keep your cash flow positive.

Use Separate Accounts

Having a sole proprietorship or a small business has its benefits to large companies. One is that your cash flow statement is way shorter, with fewer financial activities. This allows you to create separate accounts for your larger cash flow categories.

For example, some banks allow you to open a sub-account under your business account to store your savings or business emergency funds. Of course, these larger categories would be further broken down in your cash flow statement, but separating them helps you keep organized and adds an extra layer of safety. Just make sure that the account where you store your funds for operating expenses has liquidity so it’s immediately accessible for spending.

Bank alternatives like Wise let you open various accounts for different currencies, and you can also organize your funds in separate “jars” immediately accessible for transfers.

Image Source: mobiletransaction.org

Delay Expenses

Delaying your expenses is the ultimate party trick in cash flow management. It’s pretty much the only time procrastination is considered a virtue.

Remember when we said your expenses would all need a due date attached to them? This is why. Knowing when payment is actually due (and the fees or consequences of late payment) helps you bend the spacetime continuum of business finances and extend the lifespan of your operating cash flow.

You might not be able to sign up for that certification program or rent that office space just yet, but maybe you can capitalize on your existing qualifications and coach online for a while. Need a new laptop but have short cash? Perhaps you can try an installment plan. If push comes to shove, can you live on a bit less for a while and temporarily cut your salary.

Delaying expenses is not a sustainable strategy and shouldn’t become a habit. But it can get you through times when your cash flow is low or negative, creating space for new investments that help you scale in the long run.

Cut Costs

Besides delaying expenses, you can look for ways to cut them altogether.

Do you really need to rent an office space 24/7, or can you get a flexible coworking membership with a few hours a month?

Do you need your contractors to work for you on a weekly basis, or can you renegotiate your agreements to work on a project basis with them?

Maybe you can also include some of your expenses in your fees or restructure your rates to have a more balanced cash flow. Look at your costs critically to decide whether they are a real need that pushes your business forward or just an unnecessary expense.

Consider Taking out a Business Loan

If you’re projecting a negative cash flow for the coming time, you should consult with a credit provider to plan ahead for your expenses. Explore a variety of private lenders and consider easy business loans to potentially meet your needs.

Business loans should not be considered free money. You can use capital to cover planned expenses for expanding your coaching business. This can be hiring contractors, covering advertising fees, or developing new coaching products.

Always have a clear projection of the revenue these financial investments will bring in and how you’ll repay your loan. Also, have an idea of how much you’ll pay in interest, as this will affect your loan’s affordability. For example, understanding SBA loan rates can give you an idea of how much you’ll have to pay back per month.

Types of Cash Flow

You might come across different definitions related to cash flow. Some are important for small businesses, while others are more relevant for big corporations. Let’s look at the glossary of cash flow and what each term means for a coaching business.

| Operating Cash Flow (OCF) or Free Cash Flow | This is the money you have available to cover your day-to-day operation costs, from marketing expenses to renting an office. |

| Investment Cash Flow (ICF) | This cash flow type lists the purchases and sales of long-term assets such as an office building or another business. |

| Financing Cash Flow (FCF) | The inflows and outflows of financial activities like taking out and repaying a loan. |

| Positive Cash Flow | You have positive cash flow if your inflow exceeds your outflow, i.e., you earn more than you spend over a time period. |

| Negative Cash Flow | If your cash flow is negative, your outflow adds up to more than your inflow. |

| Predictable Cash Flow | Predictable cash flow means you can project consistent income from ongoing coaching contracts or subscriptions. |

| Variable Cash Flow | Your cash flow is variable if there’s a lot of fluctuation between different time periods on your cash flow statements. |

| One-Time Cash Flow | An unexpected or unusual big expense or revenue, like a speaking gig or certification fees. |

FAQ: Common Questions About Cash Flow

What’s the difference between cash flow and profit?

Your cash flow shows you all the money that moves in and out of your business. Your profit is the money that’s left after paying all your expenses. If you have a negative cash flow, your profit is zero for that time period.

Managing your cash flow means ensuring you always have the funds available for your operation costs. On the other hand, strategies to grow your revenue and profit are more long-term activities that improve the overall financial health of your business.

You can be profitable in a particular year, but your cash flow can still be negative at certain times. With proper cash flow management, you can always cover your expenses.

How Much Cash Flow Am I Supposed to Have as a Coach?

Though the exact amount may differ based on your individual business goals, you should always be cash flow positive. This means you have sufficient funds to pay yourself and other people you work with and cover all your upcoming business expenses.

If you’re expanding your business, you need to ensure you have the funds ready to invest in your growth before you need them, whether from your revenue or a business loan.

Is Cash Flow Calculated Ahead or in Retrospect?

Your business cash flow can be calculated for upcoming and past periods.

A Retrospective Cash Flow Analysis looks at all your inflows and outflows in the past. In other words, income you’ve already received and expenses you’ve already spent.

On the other hand, Prospective Cash Flow Forecasting looks at the money you’re expecting to receive and the expenses you’ll need to cover in the future by a particular due date.

You need both for managing cash flow. Past financial transactions show you the history of how your business performs, while projections help prepare for potential challenges and opportunities.

What Cash Flow Management Tools Should I Use?

You can record your cash flow statements in a simple Google sheet or Excel file. If you’re looking for something more advanced, consider bookkeeping tools like QuickBooks, Xero, or FreshBooks.

How Can I Improve My Cash Flow?

You can charge for your coaching services and products in advance to have a more stable cash flow. Taking advance payments is super easy with a tool like Paperbell that manages your client onboarding and ongoing contracts from start to finish.

You can also explore new ways you can reduce or delay your expenses. For example, moving your sessions online, working with contractors on a project basis, or establishing a referral scheme with referral codes to decrease client acquisition expenses.

If you’re short on cash or you want to expand your coaching business, applying for a loan with a trusted credit provider can help you finance initiatives to grow your revenue. Make sure you list any debt on your cash flow statement and opt for a repayment plan that fits your budget.