As an independent consultant, you provide perspective to help clients grow their businesses. It’s a rewarding career, but like any business, it comes with risks.

From client disputes to property damage or data breaches, unexpected situations can arise, even if you’ve done everything right.

That’s where insurance comes in. It may not be top of mind when you’re getting your consultancy off the ground, but having the right coverage can protect your business and give you peace of mind.

In this guide, we’ll walk you through the different types of insurance for consultants and where to find them.

[ Read: How to Start a Consulting Business: The 7 Key Steps (+ 5 Must-read Books!) ]

Why Do Consultants Need Insurance?

So, on top of all your startup costs, why should you invest in insurance?

If you’re an independent consultant and a legal issue arises, you don’t have an employer to fall back on or cover your legal fees. The bigger your client’s business and the more complex the case, the more you have at stake when offering advice.

A detailed consulting agreement helps define the terms of your engagements, but there are plenty of situations where that alone isn’t enough.

Even if you’ve done everything by the book, you might still need to hire a lawyer to resolve a dispute. Accidents can happen during meetings, like damage to your client’s property or your own. And if you have employees, you’re responsible for their safety too.

Let’s take a look at the types of insurance coverage that can help protect your consulting firm.

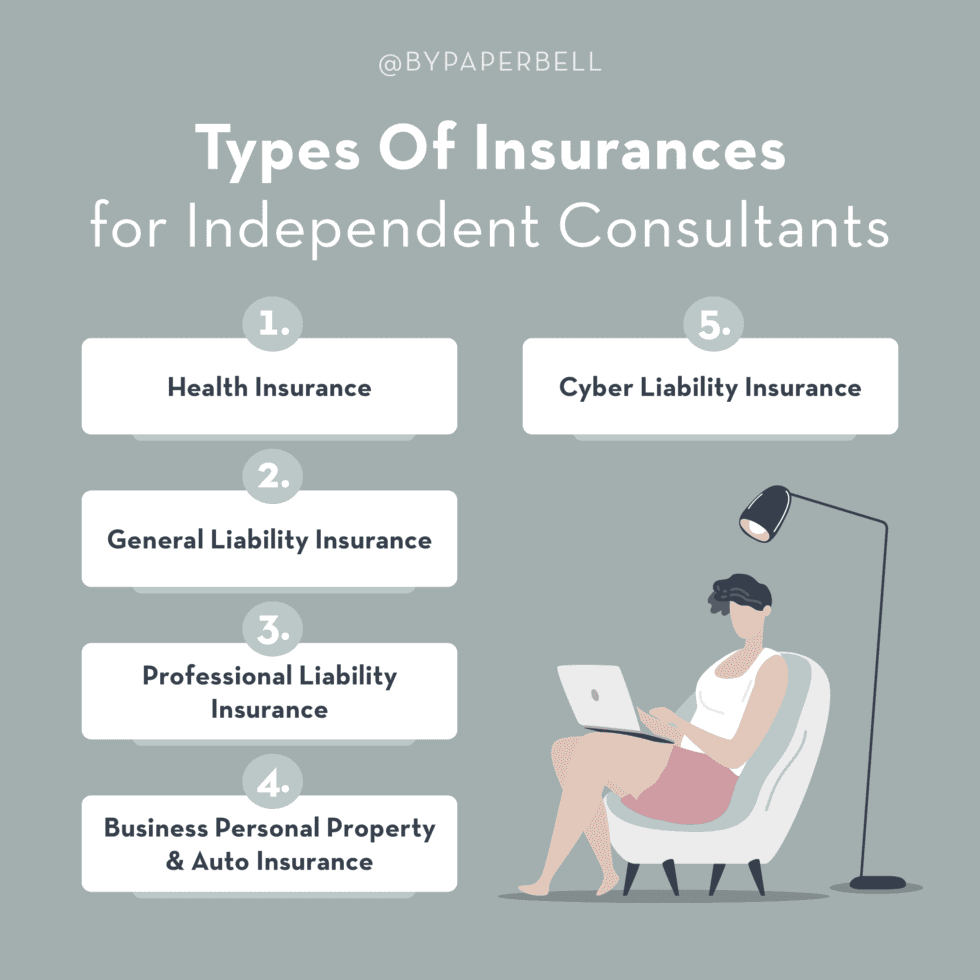

5 Types of Insurance Independent Consultants Need

Here are the most common types of insurance that can help protect your consulting business.

The right coverage depends on what kind of consulting you do. This list covers the essentials for most independent consultants, but if your work is more niche, you might need to look into additional options.

1. Health Insurance

Before we talk business, let’s make sure you’re covered personally. If you’ve recently left a corporate job to go solo (congrats, by the way!), you probably lost access to employer-sponsored health insurance.

In the U.S., one option is COBRA, which lets you keep your previous plan for up to 18 months. You might also qualify for coverage through your partner’s job, even if you’re unmarried, as a “domestic partner.”

If those don’t work for you, head to HealthCare.gov to explore individual plans, or check if you’re eligible for a small business plan. Even solo consultants can sometimes qualify.

2. Liability Insurance

If you meet with clients in person (or they come to you), general liability insurance is a smart investment. It covers accidents like property damage or injuries that happen during your meetings.

It might sound like something that only happens to other people, until your client trips on the stairs to your rented meeting room or you spill water on their laptop. If they decide to sue, your insurance can help cover legal fees, repairs, or medical bills.

In fact, some clients and venues (like coworking spaces) may even require you to show proof of coverage before working with you. It’s a simple way to protect yourself and keep things running smoothly when the unexpected happens.

3. Professional Liability Insurance

Professional liability coverage (also known as errors and omissions insurance) is there to protect you in case you’re accused of negligence or failing to deliver on your promises as a consultant.

Imagine you’ve done everything right: thorough research, careful planning, and crafting a strategy that truly impresses your client. But months later, they claim your advice caused them to lose thousands of dollars and decide to take legal action.

Even if you’re confident you did nothing wrong, a lawsuit can still be a serious drain on your time and resources.

That’s why professional liability insurance is essential. It covers your legal fees, the cost of your defense, and any settlements or damages that may arise from a lawsuit.

If you’re working with high-stakes clients or offering advice that could have significant financial implications, this insurance can be a real lifesaver.

4. Business Equipment, Auto, and Commercial Property Insurance

Personal and commercial property insurance helps protect the items you rely on for your work.

Whether you have a fully furnished office or work from home, this insurance covers everything from your phone to your office supplies. It’s there to protect you if there’s any damage to your property at your workplace.

But it’s not just for your office. If you’re out and about and your laptop gets stolen or lost, property insurance will cover the cost of replacing it.

This also extends to your car. With 6 million car accidents in the US every year, it’s a good idea to get it covered. If you’re in an accident while driving to a client meeting, your coverage can help cover the repair costs, depending on your commercial auto insurance policy.

5. Cyber Liability Insurance

As a consultant, you often have access to sensitive client data, like financials, business plans, or internal processes. Keeping that information safe is part of the job, but no one is immune to cyberattacks or data breaches.

If client data gets exposed, it can lead to a serious legal mess and a damaged reputation. That’s why cyber liability insurance (also called cyber risk or data breach insurance) is worth considering.

It helps cover legal fees, recovery costs, and other expenses if a breach happens. And since around 60% of small businesses shut down within six months of a major cyberattack, having this kind of backup can make a huge difference.

How Much Does Consultant Business Insurance Cost?

The cost of business insurance for consultants can vary quite a bit depending on your specific situation.

If you’ve got a few years of experience under your belt and a clean claims history, you’ll likely get better rates. On the flip side, if you work in a high-risk field or take on large clients, you might pay more.

Your final cost will also depend on the coverage limits you choose. Naturally, higher limits come with higher premiums, but they also offer more protection if something goes wrong.

To give you a ballpark idea, here’s what consultants in the US typically pay for different types of insurance:

| Policy | Annual Cost | Per Occurrence Coverage | Aggregate Coverage | Deductible |

| Professional Liability | $600 to $1,800 | $1 million | $2 million | $500 to $1,000 |

| General Liability | $350 to $1,200 | $1 million | $2 million | $500 |

| Commercial Property | $300 to $700 | $20,000 | $20,000 | $1,000 to $1,500 |

| Cyber Liability | $500 to $1,500 | $1 million | $1 million | $1,000 to $5,000 |

Estimates based on recent industry data for small businesses in the US. Your actual costs may vary based on location, services offered, and other factors.

Pro tip: Ask your insurer about a Business Owner’s Policy (BOP). It bundles multiple coverages (like general liability and property insurance) into one plan, often at a discounted rate. Worth bringing up on your first call.

4 Consultant Insurance Providers to Consider

The best provider for you will depend on your business size, specialty, and how much coverage you need. That said, here are four reputable companies that consistently get good reviews from business consultants.

1. Hiscox (Our Top Pick)

Hiscox is one of the most well-known small business insurance providers, offering tailored coverage to over 180 different professions across 49 states. They’re especially great for solo consultants and small firms, which makes them a solid choice if you’re running a lean operation.

They offer packages specifically designed for business consultants, so you’re not stuck piecing together a plan that wasn’t made for you. Their online application is quick and user-friendly, and you can customize your coverage to suit your exact needs.

2. Thimble

Thimble is known for speed and flexibility, claiming you can get insured in just 60 seconds. What makes them stand out is how customizable their plans are. You can choose coverage by the year, month, week, or even by the hour.

This is especially helpful if your consulting work is seasonal or project-based. Thimble also lets you adjust your policy as your business grows, so your coverage can scale with you.

3. SimplyBusiness

If you like to compare your options before committing, SimplyBusiness is a great place to start. It’s a marketplace that lists top small business insurance providers, complete with side-by-side comparisons.

You can request quotes, review what each provider includes, and find a plan that covers your consulting needs without overpaying. It’s ideal if you’re new to business insurance and want to understand what’s out there.

4. AXA

AXA is one of the biggest insurance companies globally, with a presence in over 50 countries. But they don’t just serve large corporations; they also offer tailored coverage for consultants, sole proprietors, and small business owners.

You can choose from a wide range of plans depending on your needs, and they offer 24/7 support to help you figure out what works best for your setup.

Choosing the Right Insurance for Your Consulting Business

There’s no one-size-fits-all when it comes to consultant insurance. The right policy for you depends on:

- The type of services you offer

- The size of your business

- Your client base

- How much risk you’re exposed to

Think about the worst-case scenarios you’d want to be protected from, and use that to guide your decisions about coverage types and limits.

And while insurance helps you manage risk, there’s another part of running a consulting business that’s just as important: Having the right systems in place.

From bookings to payments, contracts, and even your website, Paperbell simplifies and automates your admin and workflow so you can focus on doing your best work.

Try Paperbell free with your first client and see how simple running your consultancy can be.

Editor’s Note: This post was originally published in July 2023 and has since been updated for accuracy.