You landed your first client, delivered great work, and now it’s time to send your invoice. But if you’ve never created one before, it might not be immediately obvious where to start.

In this article, we’ll walk you through exactly what to include in your consulting invoice, what it should look like, and how to make the process smooth from the start. You’ll also get access to a free invoice template you can customize and reuse for future clients.

By the end of this article, you’ll know how to create professional invoices, avoid common mistakes, and get paid promptly, without second-guessing your process.

Note: The information in this article is not legal advice. For help with legal matters, please consult a qualified professional.

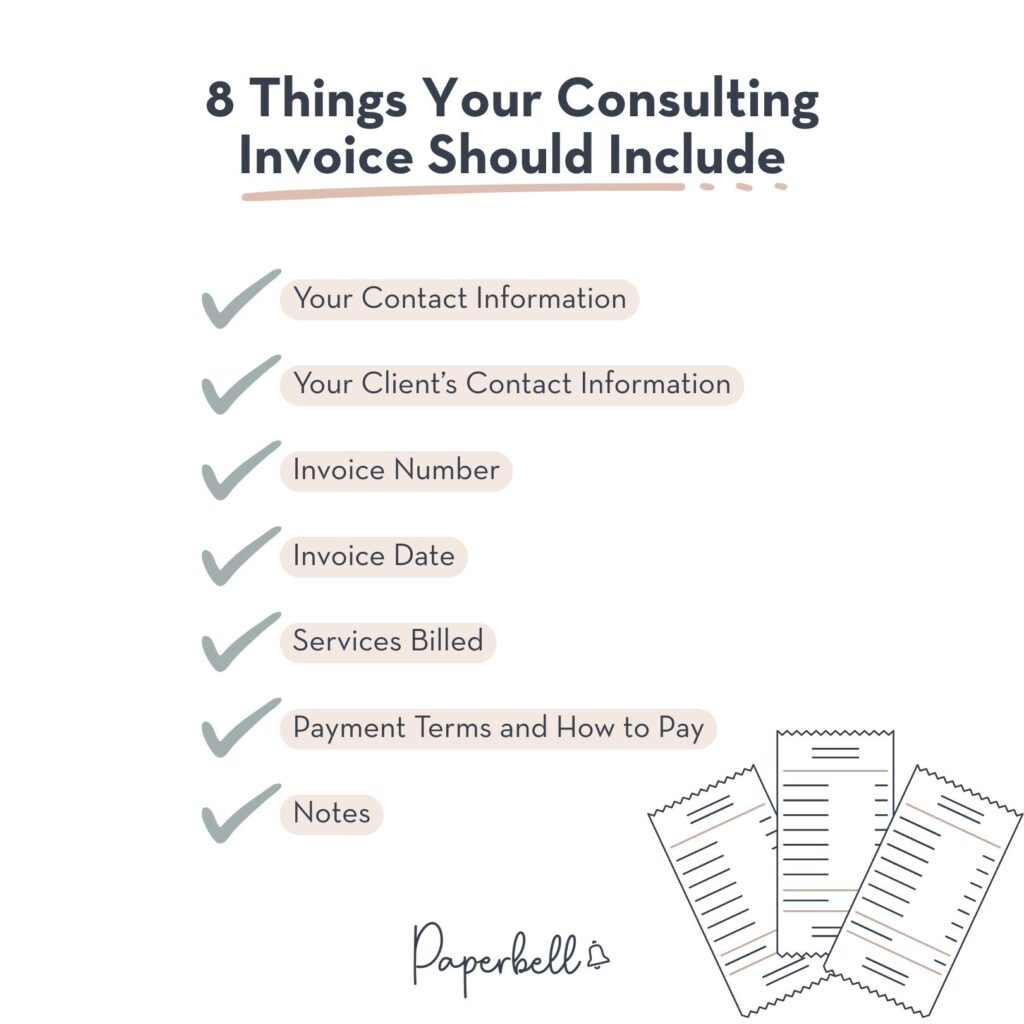

8 Things Your Consulting Invoice Should Include

Your Contact Information

Every professional invoice should clearly state your full name or the name of your registered consulting business, along with your complete business address. To avoid confusion or delays, also include your direct contact details (like your business email or phone number) even if your client already has them. That way, if someone from their finance team needs to reach you, it’s all in one place.

If you’re registered in the European Union and invoicing another EU-based business, be sure to include your EU VAT (value-added tax) number. This is a legal requirement for cross-border business transactions within the EU.

Your Client’s Contact Information

Besides your details, you’ll also need to include your client’s full legal name or business name, complete address, and, preferably, their email address. This helps clarify who the invoice is for and ensures smooth communication.

If both you and your client are in the EU, their VAT number should be listed on the invoice as well. Especially for B2B services involving reverse charge VAT, where the buyer, not the seller, is responsible for reporting the VAT on the transaction.

Pro tip: Want to skip chasing payments and manual invoices? Use a tool like Paperbell to collect billing details and full payment automatically, right at sign-up.

Invoice Number

To be considered valid, each invoice must have a unique invoice number. This helps keep your records organized and avoids confusion.

There are different ways to number your invoices, but one of the simplest and most consistent methods is to use the year followed by a sequential number. For example:

- First invoice of 2025: 2025-001

- Second: 2025-002, and so on.

Alternatively, some consultants include a client identifier in the invoice number. For example, Client 03’s first invoice might be 03-001. No matter the format, your numbering should be consistent to avoid confusion at tax time.

Invoice Date

This is the date you officially issue the invoice, not necessarily the same as the date you completed the work. Including the invoice date is essential for tracking payments, calculating due dates, and applying any late payment fees.

You may also choose to include a completion date if your services provided were finished earlier. It’s not required, but it can add clarity.

Most importantly, list the due date of the payment for your services. This should reflect the payment terms agreed upon in your contract.

Services Billed

This is where you break down exactly what you’re charging for. Be as specific as possible to avoid misunderstandings. Instead of writing “consulting services,” use descriptions like:

- “90-minute strategy session — Manhattan Project, Phase I”

- “Q2 performance analysis report”

For each line item, include:

- Unit rate (hourly, daily, or per deliverable)

- Quantity (e.g., number of sessions or hours)

- Subtotal for each service

If you’re charging VAT, list it separately for each item, based on the relevant tax laws in your country. VAT is not optional; it’s determined by whether you’re registered for it and whether it applies to your client.

Also, always indicate the currency you’re billing in, even if you and your client are based in the same country. This helps prevent disputes and delays in international transactions.

If you’ve provided any complimentary services (like a free consultation), you can list them with a price of $0 to indicate their inclusion, but this is optional.

Lastly, include the total amount due clearly at the bottom, even if there’s only one item on the invoice.

Payment Terms and How to Pay

It may sound obvious, but many consultants forget to clearly state how and when they expect to get paid. Don’t leave it up to guesswork. Include your payment terms directly on the invoice and make sure they match your contract.

For example, you can write:

Payment due within 14 days of invoice date. Late payments may incur a 2% monthly fee.

State your accepted payment methods as well. If you use Paperbell, clients can pay by card through your custom payment link. Otherwise, you can add your full bank details (including IBAN and SWIFT/BIC for international transfers) or a secure link for credit card payments.

Notes

The “Notes” section typically goes at the bottom of your invoice. Use it to include anything specific your client asked for, like internal billing codes or reference numbers.

You can also use this space to:

- Reiterate payment instructions or share alternative payment options

- Add any relevant tax information

- Include a friendly thank-you note

For example, a small gesture like “Thanks for the great collaboration!” can be a nice added touch to personalize your invoice.

3 Ways to Invoice Consulting Clients

To get paid, you can either invoice your clients using one of our free templates or take advantage of an all-in-one tool that handles everything for you. Let’s look at each option for you to consider.

1. Free Consulting Invoice Template (Copy & Paste)

If you want to create your invoice from scratch but need a reference, here’s a sample layout you can copy, paste, and customize:

Invoice No: 2022-01

From:

Colin Consultancy Ltd.

56893 Jamestown, Freeway Avenue 67

Phone: +1 122 334 455

Email: colin@consultancy.com

To:

Major Corporate Ltd.

82654 Bayland, Belle Ville Road 3

Email: major@corporate.com

Completion Date: 2/2/2025

Issue Date: 2/2/2025

Due Date: 9/2/2025

Description: Strategy consultation on the Manhattan project — Part I

Quantity: 1

Unit Price: $1000

Net Price: $1000

VAT: N/A

Total: $1000

Notes: Please settle payment via PayPal to colin@consultancy.com. Thank you for your business!

You can paste this into a Word doc, add your logo, and adjust the formatting as needed.

2. Free Google Docs Consultant Invoice Template

Prefer something editable online? We’ve also created a free Google Docs invoice template you can use. Just open it, go to File > Download, and customize it with your details.

👉 Get the Google Docs Consulting Invoice Template

Once filled out, you can save it as a PDF and email it directly to your client. Want to save time on writing that email too? Here’s how you can do that.

While templates are a great start, there’s an even simpler way to handle invoicing, especially as your consulting business grows.

3. Skip Manual Invoicing With Paperbell

Tired of editing files and chasing payments? Paperbell automates the entire invoicing process. Instead of creating and emailing consulting invoices for each project, you can simply send your client a link to your services and booking page where they can pay you by card.

You can charge a flat fee or create a recurring payment process with subscriptions and payment plans. Paperbell also handles:

- Your digital contract signing

- Client information

- Appointment booking

- Website and landing pages

- Automated client emails

It’s built specifically for consultants and coaches who want to spend less time on admin and more time doing meaningful work.

👉 Try Paperbell for free with your first client.

5 Tips for Invoicing Your Clients as a Consultant

Here are a few practical ways to make your invoicing process smoother and get paid on time, without unnecessary back-and-forth.

1. Ask for Billing Details Early (When Invoicing Manually)

Waiting until after the project ends to collect your client’s billing details can lead to delays. Instead, ask for them upfront, before you finalize your contract. This way, you can include these details in your agreement from the start.

If you use a tool like Paperbell with an automated payment process, you can collect this information at checkout while getting paid in advance. Alternatively, you can schedule an automated email in your sign-up process asking them for invoicing details.

2. Break Up Payments for Larger Projects

You don’t need to wait until the end of a long project to get paid. Instead, you can split payments into phases. For example, collecting 50% upfront and the remaining amount after a milestone or final deliverable.

You can also invoice monthly or after each major stage, depending on your timeline. With Paperbell, you can even set up packages so clients can’t book the next consultation until they’ve completed their payment.

3. Be Clear About Who Covers Extra Costs

If your consulting work involves extra costs, like software licenses, travel, or currency conversion fees, make sure to clarify who’s responsible for what before the project begins. It’s a small detail, but it can lead to awkward conversations if left vague.

It’s best to include these terms in your contract and keep receipts for any client-approved expenses so you can attach them to your consultant invoice later.

4. Double-Check Invoices Before Sending

Invoices aren’t as simple to fix as emails. If you make a mistake, you’ll usually need to void the original invoice and reissue a new one with a new number. That’s a hassle you can easily avoid.

Before you hit send, take a moment to double-check the client’s details, the total amount, and the invoice number, especially if you’re handling billing manually.

5. Minimize Manual Work Where You Can

Managing invoices as they come can be time-consuming and disrupt your workflow. Try batching your invoicing once a week or at the end of each month so nothing gets lost or delayed.

Or better yet, let Paperbell handle it all automatically. You can track consultation sessions, send invoices, and collect payments in one place, which lets you focus more on your clients and less on admin.

Editor’s Note: This post was originally published in July 2023 and has since been updated for accuracy.