Imagine you’ve started working with a dream client. You love coaching them, and it seems like they love being coached by you.

But when it’s time for them to pay their next invoice, you suddenly get crickets.

I can almost 99.9% guarantee that every coach will have to deal with non-payment at one point or another in their career. It happens to everyone.

But you can be proactive to make sure it happens as little as possible! And there are steps you can take to deal with a client who refuses to pay.

Keep reading to learn:

- The possible reasons a client refuses to pay for services rendered

- What to do when a client doesn’t want to pay you for your coaching

- How to prevent clients from not paying for your coaching services

Possible Reasons a Client Refuses to Pay for Services Rendered

People default on paying for coaching services for a multitude of reasons. But here are the most common reasons you’ll come across.

1. Lack of value perception

One of the possible reasons clients refuse to pay is if they feel they’re not getting enough value from your coaching sessions.

It could be because there was a misunderstanding about what they expected from your session or if they were dissatisfied with the results achieved.

Even if this is the case, let’s make things clear: as long as you held up your end of the deal, your client still needs to pay, even if they feel like the value wasn’t there. Of course, a good coach will try to rectify the situation to understand what’s missing or how they can improve.

2. Financial constraints

Clients who face cash flow issues often struggle with payments despite their desire to keep working with you.

Your empathy is key here while also ensuring you have strategies in place to collect payment effectively without causing undue strain on your business finances.

3. Misunderstanding about payment terms

Sometimes clients end up not paying just because they don’t fully understand when and how they should do it based on the agreed terms!

To avoid late fees and hassles with missed deadlines, communicate clearly about billing procedures and add your terms to your coaching contract.

4. Disputes over services rendered

Disputes will typically happen when coaches work without any service agreements or contracts.

A client may claim they didn’t get a specific deliverable or session. Or they’ll claim you didn’t fulfill your end of the agreement.

What to Do When a Client Doesn’t Pay

So you just got a notification from your invoicing app: Client A is late to pay their invoice. Now what?

Don’t panic just yet. Here’s how to collect money from clients who won’t pay. Start at step 1 and continue down the list as needed.

1. Start with a prompt follow-up

The first step in how to get a client to pay an invoice is simply to remind them about it.

Quick follow-ups can be a gentle way to send reminders to those who might have missed their dues in their busy schedules. Also, sometimes, payment delays happen because clients are unsure about invoice details or payment terms.

Or it can be as silly as an expired credit card. I’ve embarrassingly missed payments by accident because I’d forgotten to update my card on file.

Your timely follow-up gives clients a chance to rectify their mistake before you escalate things further.

Wondering how to remind a client to pay you? It’s up to you which medium you use to follow up. But I suggest using the method you use most often to communicate with that client, whether that’s email, social media, text, or something else.

2. Grasp your client’s financial picture

If you get a reply from a client who specifies they’re struggling, knowing and understanding where your client stands financially is the next logical step. You can’t help them – and can’t get paid – if you don’t have this information.

Once you understand what they’re going through, you’ll be in a better position to offer solutions.

3. Offer payment plans

When clients express cash flow issues and find it difficult to make full upfront payments, consider offering them structured payment plans.

After all, it’s better to get paid in installments than never at all.

By breaking down the total cost of your services into smaller, manageable payments over an agreed period, you ease their immediate financial burden while ensuring you collect what you’re owed.

4. Negotiate a lower price

The next step in how to get a client to pay an overdue invoice sounds a bit counterintuitive. But in some cases, you may not have completed every single coaching session in a package before a client defaults.

If this is the case, you can negotiate a lower price for fewer coaching sessions.

For instance, let’s say your client signed a contract to hire you for 12 one-on-one coaching sessions. You both agree to a payment plan split into four equal parts, each equal to 25% of the total.

Your client starts by paying the first 25% of your fee. After going through six sessions with your client, they suddenly default on the second 25% payment.

At this point, if the client is struggling to pay, you’d have the option to split this second payment into smaller payments as well as cancel the rest of the sessions. This way, your client would be able to pay you for the three unpaid sessions, and you wouldn’t keep doing unpaid work.

6. Tailor custom packages

If your clients can’t afford full one-on-one sessions, get creative! You can design custom packages that suit different budgets. Offer group coaching or shorter individual sessions at reduced rates instead of continuing to support them 1:1.

You can let them know you’re open to 1:1 coaching again when their financial situation changes.

This way, clients have options and won’t feel pressured to pay more than they’re comfortable with, helping you handle cash flow issues from unpaid invoices or late payments more effectively.

7. Hire a collections agency

All of the above solutions will work if a client is willing to discuss with you.

But what happens if you get ghosted by a client whom you’ve already coached and now refuses to pay at all?

Consider hiring a collections agency or a receivables management services company if the owed amount could seriously harm your finances or operations. They’re pros at chasing down unpaid debts, but keep in mind they take a cut of the recovered funds as payment.

In short, you’ll never get the full amount back – but there’s a chance the collection agency will be able to recoup some of your losses.

Make sure the agency you hire follows Federal Trade Commission (FTC) guidelines to avoid any issues. It could be a helpful solution to recover what’s owed to you.

However, if your client only owes you a small amount, it may not be worth hiring a collections agency at all.

8. Provide a final warning and follow up

If you’ve decided not to hire a collection agency and don’t want to undertake any other legal action, you should still let the client know what will happen if they do not work with you to get the debt sorted out.

There’s no such thing as too many follow-ups here. But in your final email (or call), be clear on what your course of action will be.

For example, you may remove all access to previous content you’d shared with your client. You’ll also likely cancel all future coaching sessions with them.

Just make sure that whatever action you take is in line with your coaching agreement. For example, if you state that any digital content you share with clients is theirs to keep forever, no matter what, you won’t have much legal footing to revoke access if they decide to keep a personal copy.

How to Prevent Clients from Not Paying for Your Coaching Services

So now that you know what to do when a client doesn’t pay… let’s talk about how to be proactive so it doesn’t happen again!

1. Implement a robust contract system and payment terms

The first step in preventing cash flow issues due to non-payment is to establish clear contracts with all of your clients before starting any work together.

Your contract should clearly outline what each session entails, when payment is expected, and what happens if a client doesn’t pay or pays their invoices late.

That way, if someone has a dispute, the language in your contract clarifies what to do.

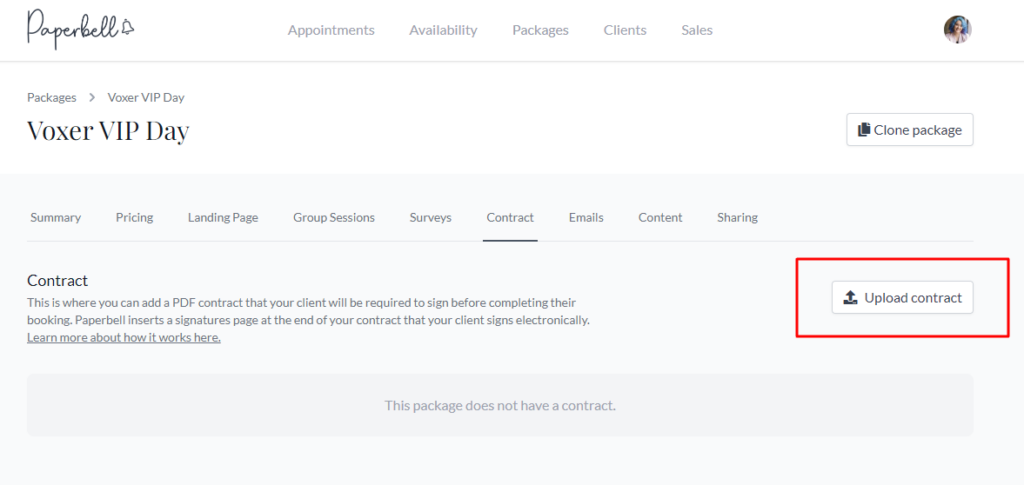

With Paperbell, you can add a contract directly to your coaching package. All you need to do is upload a PDF, and Paperbell inserts a legally binding signature at the bottom!

When you set up a contract this way, your client will automatically get a prompt to sign it before they can schedule their first session with you.

2. Maintain regular communication with clients

You know communication is key in coaching relationships – it’s just as crucial when it comes to financial matters too.

Sending out regular reminders about upcoming payments or invoice emails and addressing any concerns promptly can go a long way toward avoiding outstanding invoices.

If you keep the communication gates open, your clients will also be more likely to speak to you if they know financial hardship is coming up.

3. Set up automated payments

Your clients can’t forget to pay if their payments are set up to process automatically.

Automated payments are especially helpful for clients who have a monthly subscription or monthly payment plans with you.

There are several tools you can use to set up automatic payments, including Paperbell!

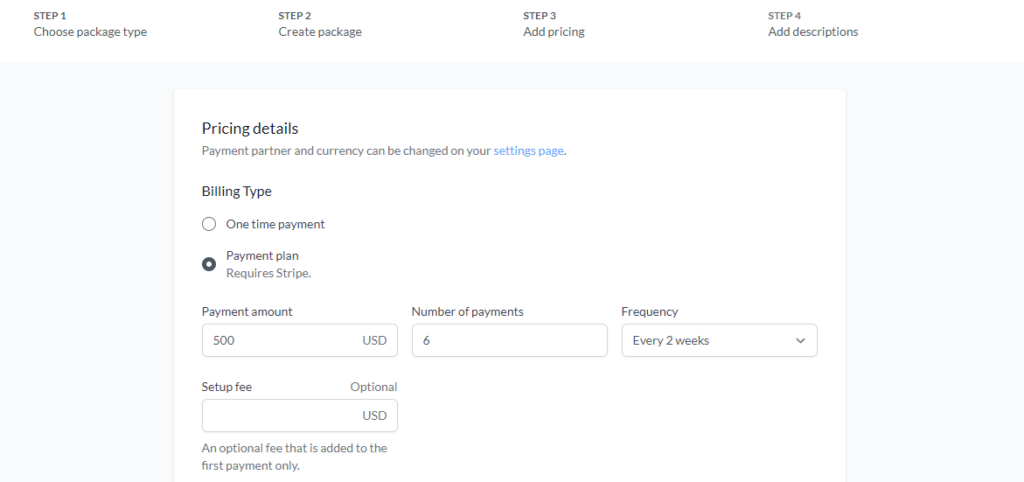

When creating a new coaching package in Paperbell, you can choose between a one-time payment or payment plan or a subscription model. Subscription models will automatically charge a card regularly, but you can do the same with a payment plan.

You can choose how many payments you’ll have and how often they happen. You can charge a one-time setup fee as a bonus if that makes sense with your offer.

Then, once clients put in their credit card information to pay the first installment, they’ll get automatically charged for the next installments.

Of course, this won’t magically mean you’ll always get paid. Credit cards can fail, for instance. But it’ll help in cases where clients just “forget”.

4. Get paid upfront

Finally, the big one:

Set up your coaching packages so that you’re never working for free. In short: ask for an upfront payment.

Now, this doesn’t mean you have to charge for the entire coaching package up front. But it does mean you only provide coaching sessions that have already been paid for.

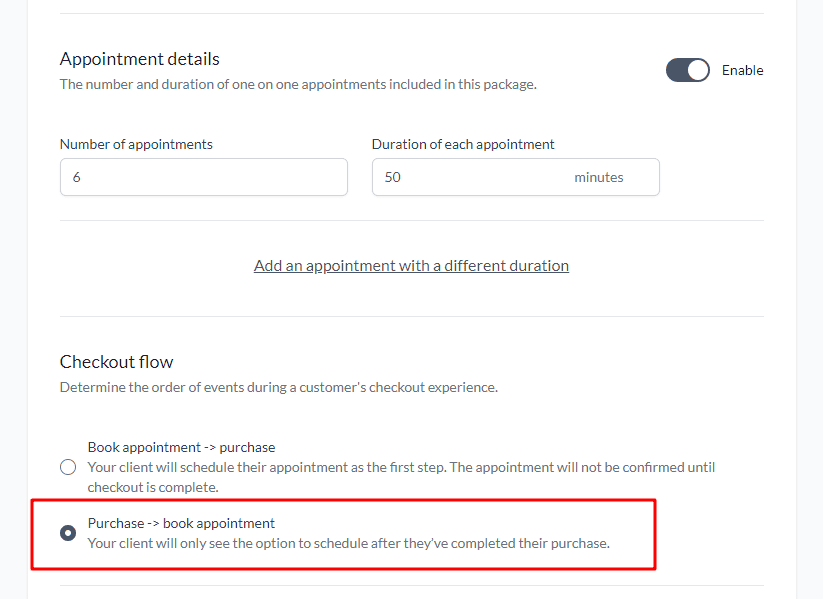

For instance, in Paperbell, you can set it up so that clients can only book their first session once they’ve purchased:

So you could have a theoretical flow that looks like this:

- You speak with a client during a discovery call

- The client agrees to your $3,000 coaching package for 12 sessions over 3 months

- To help with cash flow, you offer 3 payments of $1,000 over 3 months

- The client pays their first $1,000, then books their first session

- Before the client books a 5th session, they pay their second $1,000 installment

- Before the client books their 9th session, they pay their third and final $1,000 installment

In this scenario, even if the client were to run into a financial issue, you would never provide them with a coaching session that they haven’t already paid for!

FAQs

Are there any red flags or warning signs that indicate a client might be reluctant to pay?

Some red flags to watch for include clients repeatedly missing payment deadlines, being unresponsive to payment reminders, or showing resistance when discussing payment terms.

If a client avoids discussing payment or seems disinterested in clarifying invoicing details, it could be a sign of reluctance to pay.

Are there specific circumstances where offering a grace period for payments might be appropriate, and how can I determine the appropriate duration?

Offering a grace period for payments might be appropriate in certain situations, such as when a client has a genuine reason for a slight delay in payment due to unexpected circumstances.

To determine the appropriate duration, consider the nature of the coaching relationship, the client’s history of timely payments, and the severity of the financial challenge they are facing.

Generally, a grace period of a few days to a week is common, but it’s essential to strike a balance between being understanding and maintaining your business’s financial stability.

Implement Effective Strategies to Prevent Non-Payment in Your Coaching Business

Now you know what to do if someone refuses to pay you.

Dealing with clients who refuse to pay can be a challenging aspect of running your coaching business.

It’s awkward. But it’s necessary if you want to build a thriving business for years to come.

If you’d like to be proactive and set up your coaching business to get paid quickly and easily, why don’t you try out Paperbell for free? Your account stays free until you land your first client!